Be aware: Google has introduced a new campaign type that has replaced Smart Shopping: Performance Max Campaign (PMax). All Smart Shopping Campaigns automatically migrated to PMCs, from July 2022.

Read more about Performance Max here, or download our whitepaper for more in-depth information.

The unprecedented importance of data science

This vision is linked to our data science department, which, in addition to our online marketing background, is invaluable. Our data scientists combine different types of data every day, which leads to interesting, sometimes surprising insights. Below we will first discuss the different types of data that we see:

1) Google data: data you get back from Google

Although Google is disclosing less and less data, there is still a lot of important information that you can use. Think of conversions, costs, impressions, etc.

2) Company data: company-specific data that indicates which KPIs or factors you focus on

Company data is data that you have yourself. Think of insights into margins, stock data, and all kinds of customer data.

3) Competition data: data about what is happening in your market

The third data source is data about the market in which you are active. Are you ahead or behind your competitors? What are your competitors’ prices, which products do they offer, and which keywords do they rank for and you don’t?

Now that you understand the distinction between different types of data, we can make the leap to insights.

Optimizing Performance Max Campaigns: insights that give you a head start

Different types of data are needed to arrive at valuable insights. Sometimes this concerns insights for which you only need one data source, but we think the best insights can be found when you combine Google, company, and competition data.

The following are some examples of insights that you can now build with our software to optimize your campaigns within Performance Max:

- Understanding campaign profitability (POAS).

- Insight into cross and upsell patterns.

- Insight into prices and their importance for your rankings.

- Insight into keywords in Performance Max campaigns.

POAS insights

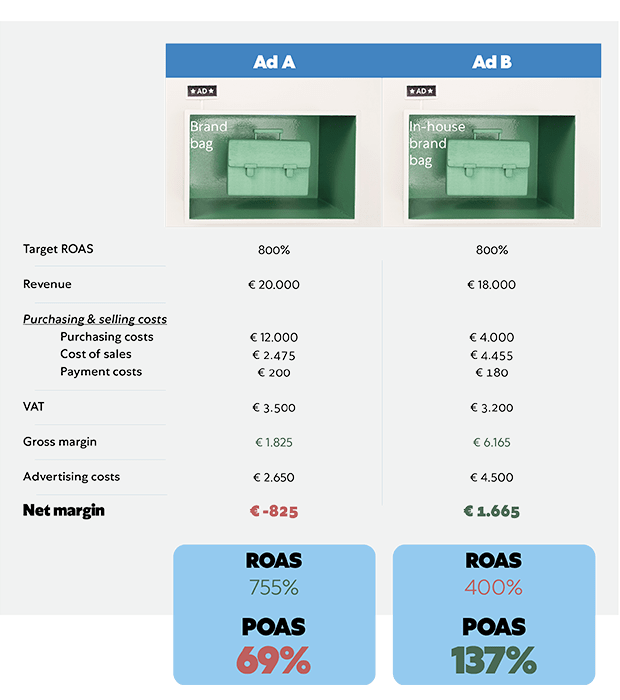

In our journey to understanding Google’s shopping algorithm, we wondered if a ROAS objective is such a good one. ROAS is just a ratio that says nothing about your profitability. What is the ideal ROAS where you achieve maximum and healthy profit and turnover? And should that ROAS target be the same for every product in your shopping campaign?

That is why more and more advertisers are now using POAS (Profit On Ad Spend) insights. Where you previously only managed ROAS revenue, now we can gain automated insights into profit by combining Google data (cost data) with company data (margins).

The image above shows that a good ROAS does not necessarily have to be a good POAS. That’s already interesting, isn’t it? In this article, you can read more about the operation and benefits of POAS.

Tip: Download the guide: From ROAS to POAS and learn how to implement Profit On Ad Spend step-by-step in your campaigns.

Cross and upsell insights

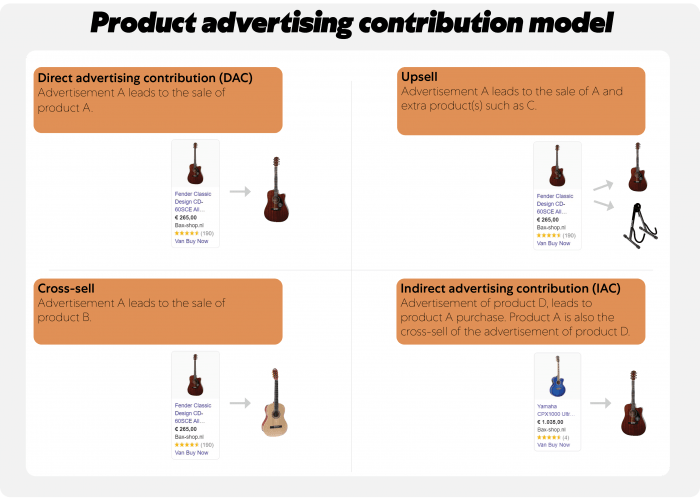

When developing POAS insights, we also realized that advertising on product A does not always have to mean that you also sell product A. It is also possible that in addition to A, you also sell product B or do not sell product A at all, but only product C.

That is why we developed the Product Advertising Contribution Model, where the central message is that the advertisement of product A does not always lead to the sale of (only) product A. The accompanying image explains and illustrates the Product Advertising Contribution Model.

This is, of course, very important when calculating your profit margin. Product C can have a very different margin than product A, and the upsell to product B may also be very interesting from a margin-technical point of view.

The effect of your price on rankings

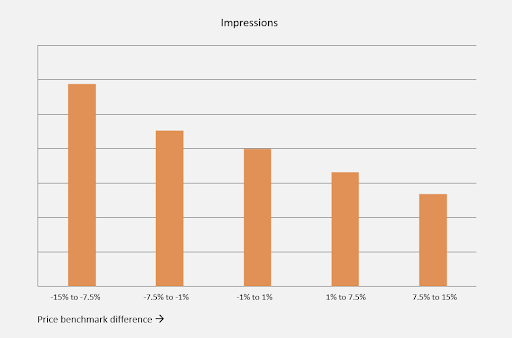

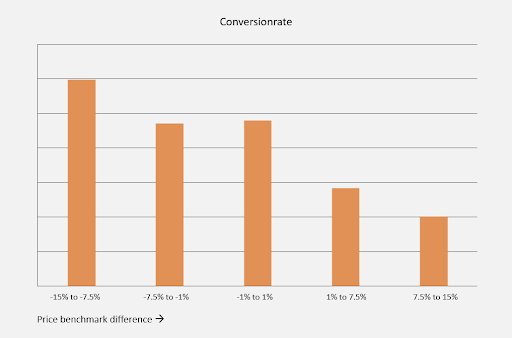

We have heard many mixed stories about the impact of your prices on rankings in Google. We also wanted to discover whether that occurred, so we started investigating. For a major retailer in the UK, we adjusted retail prices for a group of random products over a four-month period.

The products fell into one of five price ranges around the benchmark price that Google quotes, and the prices were, for example, 15% cheaper one week and 5% more expensive the next. We took into account movements within the benchmark itself, and for each product, it was randomly determined in which price range the product would fall that week. You can see the result in the graph below.

We saw a clear tapering effect in impressions. The products in the product group that had the most discount were shown the most often and were the most often clicked through. Conversely, the products that had increased in price the most were shown the least and clicked the least. So Google shows you more when you are cheaper, but the difference in conversion rate is much greater than in impressions. So price matters. By providing insight into competitors’ prices within Google Shopping, we provide an even more precise picture.

Keyword Insights

We developed a tool that produces insights within Performance Max (and before that: within Smart Shopping) at the keyword level. We do this by structurally and automatically collecting search term data through crawling. This crawl data helps you understand what is happening within Performance Max campaigns. You can see the effects at the keyword level of, for example, adjustments in your ROAS, changes in your price proposition, the effects of improvements in your product scores, the adjustments of titles, and the impact of newly added products on your rankings.

The Luqom Group, the largest online lighting provider in Europe, also uses our feature. With the returned keyword data, they can immediately optimize campaigns or see the effect of adjustments. The data is also strategically important because it allows them to closely monitor their position in relation to competition (we call this the “market share”). It also taught Luqom which products were popular within Google Shopping and those the webshop did not yet have in its range.

Would you like to know more about this subject and the possibilities it offers you? Then read this article about Keyword Insights.

Success factors for managing campaigns differently

In addition to Luqom and the large retailer in the United Kingdom, at Adchieve, we have conducted research over the past two years with other leading retailers into the success factors for applying coloring the black box. What we have learned is that four factors are important as preconditions:

1 You have to get clear on what your business objectives are.

This may seem like a clincher, but the practice is more unruly. You want to focus on improving your margin, but can that also be at the expense of your turnover? Or do you want to grow in a specific market, for example, without losing sight of your turnover/market share? Knowing your objectives is not only important for clarifying where you want to steer; it also influences which data you need and which structures you can best work with during your campaign.

2 Coloring the black box transcends the marketing department.

Anyone who wants to score in Google in the short or medium-term should also think about their range and the prices charged. For assortment-related matters, you need the involvement of the purchasing department or category management. Do you want to provide insight into the margins of your sales via Google? Then you need the expertise from the financial department. As a PPC manager or online marketer, you work less in the interface of Google and more with colleagues (from other departments).

3 You have to be open to experimentation and learning and not just thinking in direct actionables.

PPC managers are used to taking a lot of action, for example, by directly adjusting bids and keywords. The number of buttons that can be turned is a lot less with Performance Max. Therefore, it is less about the number of actions you perform but more about the quality of those decisions. Which ROAS targets and campaign structure will help you achieve your business objectives?

The above requires that you build up new knowledge by keeping up with developments in the market, and also by experimenting yourself and learning what works and what does not work in your situation. Experiments do not always lead to actionables, but they do lead to interesting new insights, which evoke new considerations that help you get closer to your objectives. This also requires commitment and involvement from someone high in the organization. That person knows the business goals, can think and direct cross-departmental actions and can initiate experiments that are not used or dared lower in the organization.

Also read: Naming convention for Google Ads

Coloring the black box in practice

Finally, you are ready, and there is commitment from someone higher in your organization. Coloring the black box also means you can act on your insights and manage your campaigns differently. How does it work?

Some examples:

- You can make substantiated changes to the ROAS of your campaign.

- You can predict the effect of a ROAS adjustment on both your revenue and margin

- Based on your keyword insights, you can estimate how much room there still is for winning positions on important search terms.

- You have insight into your own content and how it ranks.

- You see which content your competitors use (titles and images) and whether they rank better with it. Based on this, you can make substantiated adjustments to your own content.

- What are your most optimal prices? At which prices do you have the most margin but also rank the maximum within Google? In combination with your cross- and upsell insights, and with keyword data, you can come to interesting conclusions.

And finally, how great is it if you can even influence your product range? Based on the insights that we made available as Adchieve, Luqom expanded their range within one of the labels by 50%. Now that is a colored black box they profit from.

Tip: Download the guide: From ROAS to POAS and learn how to implement Profit On Ad Spend step-by-step in your campaigns.